How Wells Fargo Operates… An Example of a Private For Profit Bank

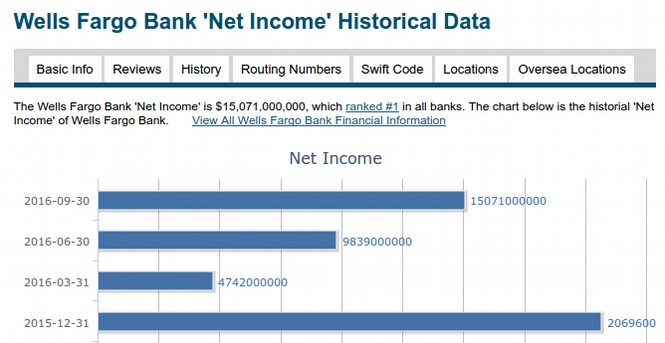

In 49 out of 50 states, private banks enjoy a complete monopoly. The only state in the US with a public bank is the state of North Dakota. Wells Fargo has 20 branches in North Dakota. Nationwide, Wells Fargo has total deposits of $1.2 trillion, net equity (assets minus liabilities) of $159 billion and a net annual income (for the past four quarters) of $50 billion. Thus, Wells Fargo has a ‘return on equity of 30% per year.

http://www.usbanklocations.com/wells-fargo-bank.shtml

As of December 31, 2016, Wells Fargo had net loans of $934 billion. Thus, the “leverage” or loan to equity ratio is $934/159 or about six to one. Put another way, Wells Fargo has about 6 times more loans than it has equity. Many banks have ten times more loans than they have equity. This is called “Fractional Reserve Banking.” When a private commercial bank makes a loan, they do not actually loan out money from their own assets. Instead, they create both an asset and a liability on their balance sheet. Some call this generating money out of thin air. But it is really just a standard banking practice.

http://www.ibanknet.com/scripts/callreports/getbank.aspx?ibnid=usa_451965

How Private Wall Street Banks Really Make Money

Many people think that Wells Fargo and other private banks make money by charging more interest on their loans than they pay on their deposits. But this is not the case. There is not actually much difference between the interest they earn and the expenses they have. For example, if Wells Fargo charges an average of 5% interest on their $931 billion in loans (including everything from Home loans to Credit card loans) while they pay an average of 2% interest on their $1.2 trillion in deposits, they would make $46 billion on their loans but pay $24 billion on their deposits. However, Wells Fargo has about a one percent default rate or $10 billion. They also have to pay wages for thousands of employees ($32 billion), pay rent on 6,000 branches and pay for everything from advertising to electricity (amounts unknown). In fact, Wells Fargo made $40 million on loans, $9 billion on government bonds, and $4 billion in “other interest” for total interest income of $53 billion. Meanwhile, they paid out $6 billion in Interest expense, $32 billion in employee costs and an unknown amount for electricty, rent and advertising. When you add up all of these expenses, there is not much difference between interest in and expenses out. So where does Wells Fargo make $50 billion per year? http://data.cnbc.com/quotes/WFC/tab/7.2

Wells Fargo Buying Back Shares of their Own Stock

The real way Wells Fargo and other big banks currently make money is by buying back shares of their own stock – which naturally drives the price of their stock up. For example, in 2016, Wells Fargo bought back about $17 billion in shares. That represents 7% of their total shares. This buy back program paid off in a stock marlet price rise from $45 per share to $58 per share – an increase of 30%. The total market capitalization of Wells Fargo rose from about $250 billion to about $325 billion – for a profit of $75 billion in 2016.

http://247wallst.com/banking-finance/2016/01/27/wells-fargo-buyback-another-positive-move/

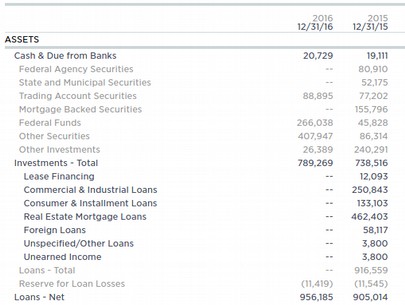

As we all know, what can go up on Wall Street can also go down. So profits today can become losses tomorrow. Even scarier is to watch how Wells Fargo has shifted its investment strategy during the past year. Here is a comparison of investments as of December 31, 2016 compared to investments as of December 31, 2015 (values in $millions):

http://data.cnbc.com/quotes/WFC/tab/7

Note that in 2015, Wells Fargo had invested $81 billion in federal securities and $52 billion in state and municipal bonds. State and municipal bonds which are used to finance public works projects like water systems are very safe investments. For example, in Washington state, there has never been a single default on any municipal bond in more than 100 years. But there is not much money to be made in State and Municipal bonds. By the end of 2016, Wells Fargo sold all of their municipal bonds. Meanwhile, their investment in “other securities” increased from $86 billion to $408 billion. What are these Wells Fargo other securities? Whatever they are, they are likely to be much riskier than municipal bonds. Basically, Wells Fargo, like the other big banks, decided to increase their risks in order to increase their profits. But this was not the only questionable action they took to maximize their profits.

Wells Fargo Billions of Dollars Price Rigging Fines

Wells Fargo has a long history of committing actual crimes in order to increase their profits. Since the 2008 crash, Wells Fargo has been involved in dozens of cases involving price rigging. Here is a year by year summary of just a few of these crimes.

2009: In November 2009 it had to agree to buy back $1.4 billion in auction-rate securities to settle allegations by the California attorney general of misleading investors.

2011: In July 2011 Wells Fargo agreed to pay $125 million to settle a lawsuit in which a group of pension funds accused it of misrepresenting the quality of pools of mortgage-related securities. That same month, the Federal Reserve announced an $85 million civil penalty against Wells Fargo for steering customers with good qualifications into costly subprime mortgage loans during the housing boom. In November 2011 Wells Fargo agreed to pay at least $37 million to settle a lawsuit accusing it of municipal bond bid rigging.

2012: Wells Fargo was one of five large banks that in February 2012 consented to a $25 billion settlement with the federal government and state attorneys general to resolve allegations of loan servicing and foreclosure abuses known as Robo-signing. The New York Attorney General later sued Wells Fargo for breaching the terms of that settlement. In July 2012 the U.S. Justice Department announced that Wells Fargo would pay $175 million to settle charges that it engaged in a pattern of discrimination against African-American and Hispanic borrowers in its mortgage lending from 2004 to 2009.

2013: In January 2013 Wells Fargo was one of ten major lenders that agreed to pay a total of $8.5 billion to resolve claims of foreclosure abuses. In October 2013 Freddie Mac announced that Wells Fargo would pay $869 million to repurchase home loans the bank had sold to the mortgage agency that did not conform to the latter's guidelines.

2016: In April 2016 the Justice Department announced that Wells Fargo would pay $1.2 billion to resolve allegations that the bank certified to the Department of Housing and Urban Development that certain residential home mortgage loans were eligible for FHA insurance when they were not, resulting in the government having to pay FHA insurance claims when some of those loans defaulted. In August 2016 the Consumer Financial Protection Bureau announced that Wells Fargo would pay a penalty of $3.6 million to resolve allegations that it engaged in illegal student loan servicing practices. In September 2016 the CFPB imposed a fine of $100 million against Wells Fargo in connection with the revelation that for years bank employees were creating large numbers of new accounts not requested by customers to generate illicit fees.

Wells Fargo Summary

It should be obvious from the above that Wells Fargo is far from the quiet community bank that makes money from the interest difference between loans and deposits. Instead, Wells Fargo makes money from gambling, stock market manipulation, fake accounts and price rigging. Perhaps this is why the City of Seattle recently voted to pull $3 billion out of Wells Fargo. Now that we have a better idea of how a private for-profit bank like Wells Fargo works, let’s look at the public Bank of North Dakota.

How the Bank of North Dakota Operates… Banking in the Public Interest

Unlike Wall Street banks, the public Bank of North Dakota is not listed on the Stock Exchange. Its only stock holders are the people of North Dakota. There are no stock buybacks to artificially inflate the share price. No gambling. No federal lawsuits. No fake accounts. No price rigging.

Bank of North Dakota, Annual Report, 2015

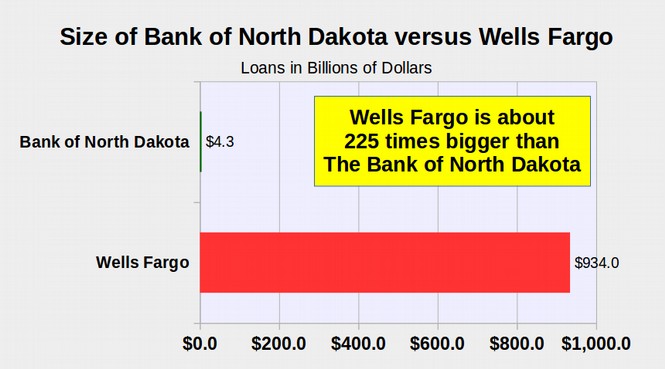

According to its 2015 annual report, the Bank of North Dakota posted its 12th consecutive year of record profits with more than $130 million in income. Assets increased to $7.4 billion. The loan portfolio grew to $4.3 billion. Total net equity is $750 million. Return on equity 130/750 =was 17% per year. The Leverage Ratio or Loans to Equity was 4300/750 = 5.7 which means that BND has a leverage ratio of about 6 to 1 – very similar to Wells Fargo.

https://bnd.nd.gov/pdf/2015_bnd_annual_report.pdf

To better demonstrate the dramatic difference in size between the Bank of North Dakota and Wells Fargo, here is a graph of their loan portfolios:

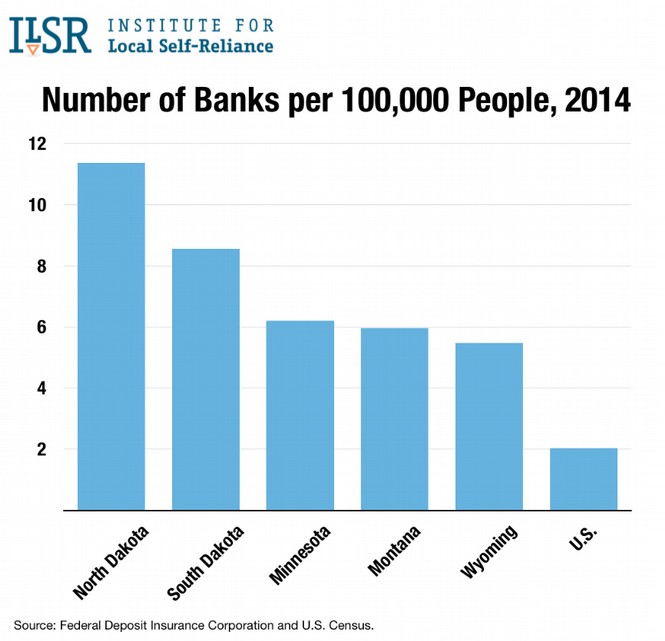

It should be obvious from the above graph that the tiny public Bank of North Dakota is not in any way a threat to Wells Fargo. Nor is the Bank of North Dakota a threat to local community banks. In fact, the Bank of North Dakota often “partners” with local community banks on local projects. This is why North Dakota has the highest rate of community banks per 100,000 people of any state in the nation.

How the Public Bank of North Dakota Lowers the Cost of Building Public Schools

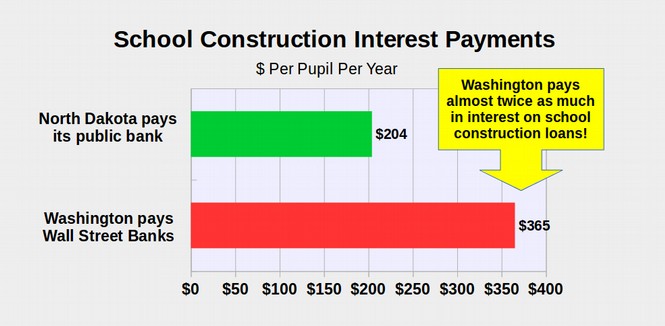

A hidden benefit of the public Bank of North Dakota is that they offer lower interest rates on public works projects like public schools. For example, while Wall Street Banks might charge a local school district interests and fees as high as 4%, the Bank of North Dakota only charges school districts 1% to 2% on loans to build schools. This cuts the cost of building schools by as much as 50% resulting in lower property taxes for local homeowners. It also results in much lower long term debt.

For example, according to the Public Education Finances 2014 Report Table 9 published in June 2016, Washington has about ten times more students than North Dakota (1,057,773 versus 103,272). But Washington School Construction debt is about 20 times more than North Dakota with Washington schools having a total debt of almost $10 billion while North Dakota schools have a school construction debt of only $441 million. Washington schools pay $386 million in interest payments while North Dakota schools pay only $21 million in interest payments. Meanwhile North Dakota invests about 50% more in school construction per pupil ($1,728 versus $1,120). At the same time, the per pupil long term debt in North Dakota is about half the per pupil long term debt in Washington ($4,282 versus $9,403) and the per pupil interest on debt is also much less ($204 per pupil per year versys $365 per pupil per year). Subtracting these interest payments, Washington only invests $755 per pupil per year on school construction while North Dakota is able to invest twice this amount ($1,524)

https://www2.census.gov/govs/school/14f33pub.pdf

Here is a table of the above information:

| Comparing Washington to ND |

WA Total ($ millions) |

ND Total ($ millions) |

WA per pupil per year ($) |

ND per pupil per year ($) |

| School Construction |

1,185 |

178 |

1,120 |

1,728 |

| Interest on School Construction Debt |

386 |

21 |

365 |

204 |

| School Construction minus Interest Payments |

799 |

157 |

755 |

1,524 |

| Long Term School Construction Debt |

9,948 |

441 |

9,403 |

4,282 |

Source: Public Education Finance 2014 Table 9

Here is a graph of interest Washington Schools pay to private for profit Wall Street banks versus what North Dakota Schools pay to the public Bank of North Dakota.

Summary… It is Time for a Public Bank in Washington State

North Dakota invests twice as much per pupil in building schools while Washington pays twice as much in interest payments per pupil to Wall Street banks. Also while Wells Fargo has stopped buying state and municipal bonds – making it harder to finance public works projects – the public Bank of North Dakota has as one of its prime missions to finance state and municipal bonds at very low interest rates making it easier to finance public works projects.

Here is a table showing how a public bank is much different from a Wall Street Bank:

| Wall Street Banks |

Public Banks |

|

| Mission |

Maximize Short term Profits |

Serve public needs |

| Major Activities |

Casino High Risk Gambling Stock Market Speculation Price rigging and tax evasion Very high interest rates. |

Safe Investments in Public Projects… Very Low interest rates to lower the cost for Public Schools and Public Works Projects |

| Overhead |

Huge overhead in advertising and lots of branches |

Almost no overhead. The Bank of North Dakota only has one branch! |

| Profits Go To |

Bank Insiders and Stock Holders |

Tax Payers through lower costs to local and state governments |

Rather than the fake claim that a public bank would harm Wall Street banks, what really happens when we place private corporate greed above the needs of our students is that our kids are harmed by being forced to attend schools that do not meet health code standards and our local tax payers are harmed by being forced to spend twice as much as they need to in order make the interest payments to Wall Street banks. It is time for our legislators to show they care more about our kids and our tax payers than about protecting the profits of Wall Street banks. It is time to create a public bank in Washington state similar to the public bank of North Dakota.