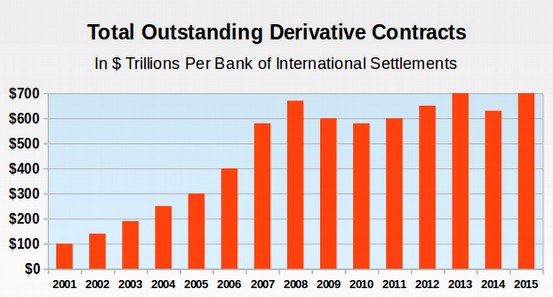

According to the Bank of International Settlements, there are about $700 trillion in financial derivative contracts held by the major Wall Street banks today. Most of these are liabilities of two big banks, Chase Bank and Bank of America. Some have called derivatives “weapons of financial destruction.” Others claim that derivatives are gambling in a rigged casino where the House (the big banks) nearly always win. As derivate losses were responsible for the 2008 financial collapse and the trillions of dollars in bank bailouts from US taxpayers, in this article we will take a closer look at what derivatives appear to be and what they really are.. namely a symptom of fraud, corruption and theft on a massive scale that could lead to a financial collapse much worse than the 2008 Crisis – and even worse than the Great Depression.

Defining Derivatives… Not insurance, Not a Bet, But a Robbery

The big banks and the corporate media claim that derivatives are merely an Insurance Policy such as insurance against rising interest rates – just as we insure ourselves against a car accident or house fire. But financial derivatives are not at all like an insurance policy. With an insurance policy, the Insurer is required by law to keep enough funds in reserve to cover potential losses. If you have insurance on your home and it burns down and the insurer refused to pay for a new home, the government would quickly shut down the insurance company and we would all recognize it as a fraud. However, these regulations do not apply to financial derivatives. So unregulated derivatives are not the same as an insurance policy in that while an insurance company is limited in the amount of insurance contracts they write, Too Big to Fail Banks are not limited in the amount of Derivative Contracts they write. Big banks can and do write contracts that are thousands of times more than the net worth of the bank!

Derivatives have also been described as a bet between a Too Big to Fail Bank and one of their customers (also known as a chump) regarding the direction of a particular financial instrument such as the direction and amount that interest will rise on a variable rate loan. But derivatives are not like gambling debts because it is not possible for the Too Big to Fail banks to lose. For example, a school district or city may want to protect themselves from too great a rise in interest rates on a particular construction project such as building a new high school. So they pay a bank to limit their liability. The bank bets that interest rates will not rise and gets a fee from the school district. The bank wins millions of dollars if they are right. The US tax payers lose billions of dollars if the bank is wrong. In other words, derivatives are not actually crooked gambling debts in a rigged casino. Instead, when the big banks occasionally lose, they simply refuse to pay and we the tax payers are forced to pay off their losses for them.

At least that is how it was in 2008. Today, there is a new punishment that will be inflicted on the public the next time the Too Big to Fail Banks lose a bet. It is called Confiscation. Under the new FDIC confiscation rules, people who keep their money in Too Big To Fail banks (called Depositors) will lose their assets and be given worthless bank stock in trade for their assets. For example, the State of Washington keeps more than one billion dollars in Bank of America to cover outstanding checks to State employees. Should Bank of America lose a bet, this one billion dollars would be converted into Bank of America stock which Bank of America could use to pay off the corporation it was gambling with (say for example Goldman Sachs). The State of Washington would get one billion dollars in Bank of America stock.

But what about State employees who try to cash their pay checks?

There would be no money left in the State Bank account as it all went to pay off the Derivative losses of Bank of America. So these pay checks would either not be honored. Or more likely, there would be an emergency meeting of the State legislature where a billion dollars would be cut from some other program (such as public school funding or higher education funding) in order to put a new billion dollars into Bank of America to cover the billion dollars in bank losses. In other words, the bank bailout would not be covered by federal tax payers. It would be covered by State tax payers. Either way, because the bank cannot lose, it is not a form of gambling. Derivatives are simply a form of legalized theft – legalized robbery.

History and Rise of Derivatives

Before the banks took over Congress and changed the laws, derivatives or gambling by big banks was illegal. This all changed with the repeal of the Glass Steagall Bank Regulation Act in November 1999. The few honest members of Congress left in 1999 protested that repealing Glass Steagall would lead to economic disaster within 10 years. As it turned out, it only took 9 years.

Here is a chart showing the rise of derivatives since the year 2001 according to the Bank of International Settlements: http://www.bis.org/statistics/derstats.htm

Types of Financial Derivative Contracts

There are five major types of financial derivative contracts: Interest Rate Swaps, Currency Swaps, Credit Default Swaps, Commodity Futures Options Contracts and Stock Market Futures Options Contracts.

While most Derivatives are interest rate swaps, these were not what caused the 2008 Crash. It was the Credit Default Swaps that led to massive financial losses – in part due to another complex financial contract called Mortgage Backed Securities which suddenly lost all value after the collapse of the Real Estate bubble. Credit Default Swaps are bets that a particular city, state or corporation will default on their debt. These days it is popular to bet on when Greece will default on its debt. But one can also bet against Detroit or Chicago or LA. Should one or more cities or countries default on their debt, the financial losses could be staggering. However, credit default swaps are not the only danger created by allowing big banks to assume unlimited liabilities with no means to pay should something go wrong.

Are Oil Futures Contracts The Next Financial Risk Bubble to Explode?

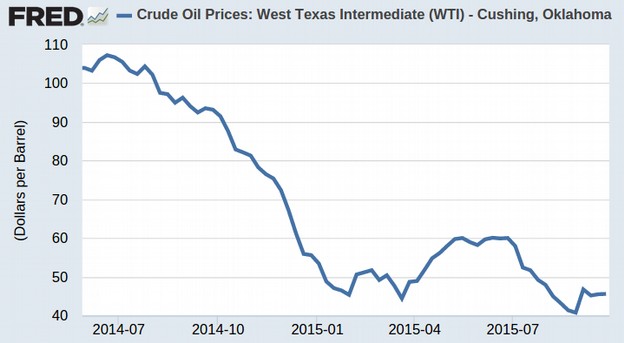

You may have noticed that the price of a gallon of gas has dropped slightly in the past year. This is because the price of a barrel of oil has dropped from more than $100 a barrel to less than $50 a barrel. Apparently Saudi Arabian leaders need the money to finance their various wars. So they dumped a bunch of oil on the world market. But do to the Global Recession, there is not enough demand for this oil. Since supply exceeds demand, the price of oil naturally falls.

The Oil Commodity Bubble Pops

The following graph shows the decline in the price of a barrel of oil from July 2014 to September 2015. https://research.stlouisfed.org/fred2/series/DCOILWTICO

While lower gas prices may seem like a good thing, this rapid drop in price is not a good thing for commodity future dealers who failed to realize that the price of oil could go down by more than 50%. Many banks who invested in the Oil Market are in the process of suffering major losses on their derivatives contracts and other oil related investments.

Apple Core, Say No More, Whose Your Friend? Glencore!

The poster child for this problem is a commodity trading bank called Glencore. It was recently revealed that Glencore has a liability of more than $100 billion in oil derivatives contracts associated with Too Big to Fail Banks. http://www.zerohedge.com/news/2015-10-07/shocking-100-billion-glencore-debt-emerges-next-lehman-has-arrived

Think of Glencore as the next Lehman or AIG. Should Glencore fail, it would launch a series of dominoes that could bring down the Big Banks. However, as the Zero Hedge article notes, Glencore is likely just the tip of a rather ugly iceberg should the Oil Bubble continue to explode.

“Since it is not just Glencore that the banks are exposed to but very likely the rest of the commodity trading space, their gross exposure blows up to a simply stunning number.”

The article then mentions three other commodity derivatives trading companies with huge balances at big banks and concludes that the total exposure may be $500 billion. Here is the quote: “Call it half a trillion dollars in very highly levered exposure to commodities: an asset class that has been crushed in the past year… Glencore is increasingly - and belatedly - seen as the fulcrum entity in what may be the watershed event for any wholesale commodity-trading industry collapse.”

The Next Financial Collapse Could Occur in as Little as Two Days

The Zero Hedge article compared the financial risk of Glencore (which is now likely to see its credit rating downgraded) to another risky company you may have heard of called Enron: “At Enron, the company used funding structures which were dependent on its investment grade rating so that, effectively, 2 days after the company was downgraded to junk, it was “done”.”

It is not very reassuring to learn that Derivatives gambling (or whatever you want to call it) could blow up the big banks in as little as two days.

Dominoes, Ponzi Schemes & the Concentration of Wealth and Power

Of course, when Enron failed, it did not bring down the entire economy. Nor did it bring down the stock market. But Enron was never more than a small fraction of the total economy. Derivatives on the other hand, at $700 trillion dollars, are many times larger than the entire GDP of the entire world. We as humans have never seen fraud and corruption on this massive of a scale. The Federal Reserve has already wasted trillions of dollars of tax payer funds, through quantitative easing, buying up the Toxic assets of Too Big to Fail banks in a futile attempt to prop them up. The reality is that any honest accounting would reveal that the big banks are all zombie banks – with debts that far exceed their assets. The Fed balance sheet is now over $4 trillion. How much longer the Fed can go on with this bank Ponzi scheme is anyone's guess. But history tells us that no Ponzi Scheme can go on forever. There is also no question that the current bank Ponzi Scheme is the largest Ponzi Scheme in history – many times larger than the Ponzi Schemes that led to the Crash of 1929 and the Great Depression.

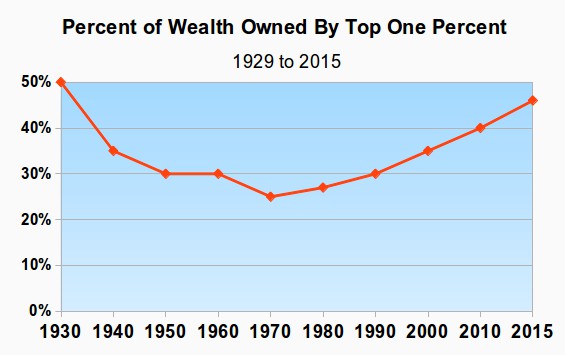

There are several other factors that make the current financial situation much worse than the Crash of 1929. First, the concentration of wealth and power is nearly as great as it was in 1929.

Source: Saez and Zucman, October 2014, National Bureau of Economic Research

http://gabriel-zucman.eu/files/SaezZucman2014.pdf

People are kept in the dark about this concentration of wealth and power because nearly all sources of news are controlled by just 6 mega corporations. They have imposed a news blackout on anything remotely resembling the truth.

For example, did you know that the real unemployment rate – when counting all working age adults and counting only full time jobs – is more than 25%. Or that the real unemployment rate among young adults is more than 50%. It sounds absurd, doesn't it?

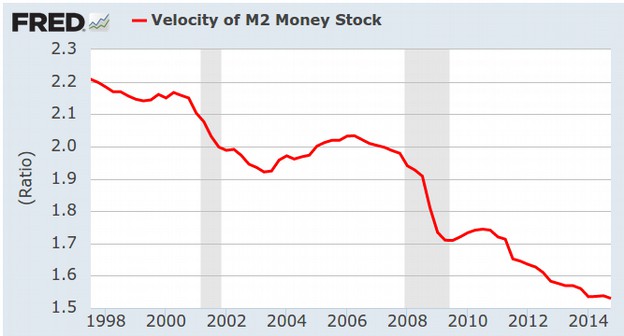

Without real jobs, the net worth of half of all Americans is no ZERO – the same as the net worth of the Zombie Too Big to Fail Banks. Without any money, people cannot spend. Which means that the real economy is on life support. One measure of the real economy is called Money Velocity or the rate at which money changes hands. Because billionaires control all of the wealth, the money velocity is at an all time low.

Here is the drop in Money Velocity since 1997:

https://research.stlouisfed.org/fred2/series/M2V

In 2015, this number fell below 1.5 for the first time ever. So the claim that economic recovery is just around the corner is absurd.

But there are other factors that make the current situation much more dangerous than the Crash of 1929. Back then, over half the population lived on farms – including my parents and grandparents. When the crash came and the banks shut down and jobs disappeared, folks were still able to grow their own food. They could take in friends and relatives to keep folks from starving. People traded their labor for something to eat.

But today, over 90% of all Americans are crowded into cities. They rely entirely on the super markets and trucking system to bring them food from mega farm factories where food production is now controlled by a few billionaires – just like the media is controlled by a few billionaires. These mega stores depend on the mega banks to stay open. If the mega banks collapse, mega super markets could also close. If there is a disruption in the food supply chain for even a few weeks, it could be a disaster for people living in cities. So the next financial collapse could be much worse than the Great Depression.

Who is in charge?

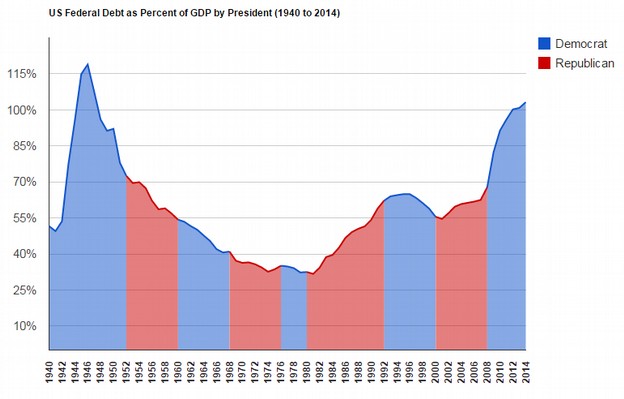

In the 2008 bank bailout, both parties agreed to give the big banks hundreds of billions of dollars and have consented to raising the national debt by trillions of dollars. As a quick recap, at the end of Bill Clinton's term, the national debt was $5 trillion. At the end of Bush 2's term, it doubled to $10 trillion. It is currently $18 trillion and is on pace to be more than $20 trillion by the end of Obama's term in office. This is about $60,000 for every person in the US. This does not include personal debt which is also exploding. Of course, the correct way to look at the National Debt is as a Percent of GDP. Viewed in this manner, we are now over 100% of GDP and approaching the debt incurred during World War II.

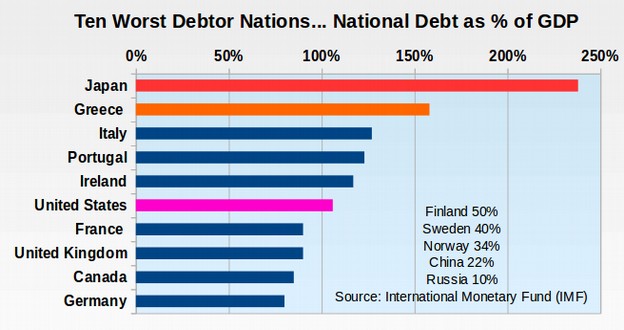

According to the International Monetary Fund, this puts us in six place of world's ten worst Debtor Nations. Here is the Top Ten: https://en.wikipedia.org/wiki/List_of_countries_by_public_debt

By comparison, so-called “socialist” countries have almost no debt. Finland is at 50%, Sweden is 40%, Norway is 34%, China is at 22%and Russia is at only 10%.

While everyone was focused on the Greeks defaulting on their 160% of GDP debt load, Japan is in much worst shape with 230% of GDP debt load. They have much more debt than Greece. A default of debt in Japan could also trigger an international banking crisis.

Ironically, the US is also in danger of defaulting on our debt. This is because there are a group of conservative Republicans in Congress who are opposed to bank bailouts and opposed to further increases in our national debt. Recently, they booted out the Speaker of the House John Boehner. His top assistant, Kevin McCarthy, has also refused to run for speaker. What many Americans do not understand is that Congress and not the President controls the purse strings to our national government. The Speaker of the House is therefore more important than the President of the United States. The Speaker position is currently vacant. Without a Speaker, there is no way to move a funding bill through Congress. The last time this crisis occurred was shortly before the US Civil War. Conservative Republicans have vowed to shut down the government which will result in the United States defaulting on debt payments on or about December 11 2015. Some claim that legislation must be passed by early November 2015 to avoid a default. Should a default occur, the credit rating of US Treasury Bonds would be lowered and the interest rate on the debt would go up. Currently, the only way we can afford such a huge $18 trillion debt is because the average interest rate on the debt (which is similar to the rate on the 10 year Treasury Bills) is only 2%. As a result, the annual payment on the debt for the past year was only $400 billion. However, should the interest rate rise to a historical average rate of 4%, the interest would rise to $800 billion per year.

Perhaps this is one reason that China has been selling rather than buying US Treasury Bonds. Here is a quote from the Wall Street Journal on October 7 2015: “Central banks around the world are selling U.S. government bonds at the fastest pace on record, the most dramatic shift in the $12.8 trillion Treasury market since the 2008 financial crisis.”

Specifically, in July 2015 alone, China sold $100 billion in US bonds. China still has $1.3 trillion in US bonds. It can therefore keep selling US bonds at this monthly rate for an entire year. The “buyer of last resort” for these bonds has been the US Federal Reserve - which currently has a balance sheet of $4.5 trillion including $2.5 trillion in US Treasury bonds and $2 trillion in bank toxic assets. The Fed balance sheet is growing at a rate of about $1 trillion per year half of which is Treasury Bond purchases and the other half of which is buying toxic assets from Wall Street banks (also called worthless Mortgaged Backed Securities).

We are not alone in being worried about a coming financial collapse

While things look pretty bad right now, perhaps we are wrong. After all, we are just a couple of college professors who have only been studying flaws in the banking system for the past 7 years – ever since the 2008 bank collapse. There is always the chance that $700 trillion in big bank gambling bets will work out OK.

But others are also concerned about the current financial crisis. Here is Yale economics professor, Robert Shiller talking about the CAPE ratio, more commonly called the Cyclically Adjusted Stock Price to Earnings ratio: “The CAPE ratio has recently been around 27, which is quite high by US historical standards. The only other times it has been that high or higher were in 1929, 2000, and 2007—all moments before market crashes.”

The title of the article is “Unlike 1929, this time everything, stocks, bonds and housing, is overvalued.” http://www.zerohedge.com/print/507258

Here is another Shiller quote in the Financial Times from September 14 2015:

“A growing number of investors believe that US stocks are overvalued, creating the risk of a significant bear market, according to research by Yale University market scholar Robert Shiller. The Nobel economics laureate told the Financial Times that his valuation confidence indices, based on investor surveys, showed greater fear that the market was overvalued than at any time since the peak of the dotcom bubble in 2000.”

Margin debt was a huge factor in the 1929 crash, the 2000 crash and the 2008 crash. It is currently at its highest value in history.

Bubbles Bubbles Boils and Troubles… What will happen when Humpty Dumpty Falls Off the Wall?

Thanks to risky banks like Glencore, we could see the commodity bubble burst – but the stock market bubble is just as big if not bigger. There is also the re-inflation of the housing bubble. Any one of these bubbles could cause the Humpty Dumpty Too Big to Fail Banks to fail.

It is useful to compare the Too Big to Fail Banks to Humpty Dumpty, described by Lewis Carroll in his futuristic book, Through the Looking Glass. Alice runs into Humpty Dumpty and learns the true meaning of power. Like modern Too Big To Fail Banks, Humpty Dumpty claimed that words meant whatever he wanted them to mean:

"When I use a word," Humpty Dumpty said, in rather a scornful tone, "it means just what I choose it to mean—neither more nor less." "The question is," said Alice, "whether you can make words mean so many different things." "The question is," said Humpty Dumpty, "which is to be master—that's all."

Alice meets Humpty Dumpty in Through the Looking Glass by Lewis Carrol

The question for all of us is whether we are to be the master of our economy and our democracy or whether we will continue to let the big banks control our economy and democracy – making all of us mere debt slaves of the big banks. Either way, no amount of power can hide the truth of Big Bank fraud and corruption forever. It is only a matter of time until one of more of the many financial bubbles pop. When they do, Humpty Dumpty is going to fall off the wall. As we all learned as children: “All the King's Horses and all the Kings men, could not put Humpty together again.”

Our only hope of not going down with the Too Big to Fail Banks is to set up our own well regulated Public Bank – a bank run not for short term private profit - but to serve the long term interests of the public good, a bank that does not invest in the risky derivatives market but invests in public projects to better our local communities. To that end, we hope you will join us and help create a public bank here in Washington state. As always, we welcome your questions and comments.

Regards,

David Spring M. Ed. & Elizabeth Hanson M. Ed.

Washington Public Bank Coalition