Public Cash Receipts Give Bank of America $200 million per year

Washington State currently processes nearly $300 billion in tax receipts through Bank of America each year. The State Treasurer claims that we are getting a good deal because Bank of America only charges the State of Washington $240,000 per year for this “service.” The State Treasurer claims that the average balance in this account is less than $100 million. We earn nothing in interest on this balance. But thanks to the wonders of “fractional reserve banking”, Bank of America is able to translate this deposit into $1,000 million (one billion dollars) in loans that they earn about 5% interest on per year. This comes to about $200 million per year that our State gives to Bank of America. But this is just the tip of the iceberg.

On any given day, we have about a $4 billion cash balance beyond what our state needs to pay its bills. The State Treasurer says they invest this $4 billion in short term Treasury Bills on which they make about $70 million per year. This is a return on investment of less than 2% per year. If we used fractional reserve lending through a public bank, just as the private banks do, we could covert this $4 billion into $40 billion in public projects with savings of more than $3 billion in interest payments per year. Still, we are helping the federal government out by buying $4 billion in revolving short term US bonds, so we will chock this massive loss up to be patriotic. This also is just the tip of the iceberg.

Bond Payments on Public Projects Give Wall Street Banks $3 billion per year

Washington state also has at least $30 billion in loans from Wall Street Banks for public projects. This is divided into three categories:

#1: About $10 billion in General Obligation bonds to build whatever buildings the State legislature wants including colleges and universities.

#2 About $10 billion in K12 Public School Construction Bonds to pay for a fraction of the cost of building public schools.

#3 About $10 billion in Road Construction bonds to build roads and bridges – paid for in part by gas taxes.

The payments on this $30 billion are about $6 billion per year of which $3 billion is interest/profit for the Wall Street banks and the other $3 billion is to pay off the principal of the bonds (which is never actually paid off because the principal keeps on growing every year). Our next article provides a more detailed analysis of our Washington State bond debts with links to the source documents. But before we cover the bond problem, we will first mention the real “give-away” which is about $80 billion in State Pension funds and other State Financial assets. This is supposedly a retirement account for all state workers including police and fire fighters and teachers and judges and paramedics and all kinds of other state workers. The claim was that our State Treasurer would invest this in “safe investments” like US Government Treasury bills. However, less than 10% of our pension funds is actually invested in safe US Government bonds. The remaining 90% - or more than $60 billion – is invested in the worst assortment of Wall Street gambling you have ever seen – in a futile effort to make a quick buck on the current stock market bubble. This includes not only investments in all kinds of stocks but also Credit Default Swaps and Mortgage Back Securities – the sort of risky investments that led to the 2008 stock market crash.

Of the $80 billion total invested by the Washington State Investment Board under the supervision of the State Treasurer, the tiny fraction invested in safe Treasury bills is somewhat hidden is a misleading annual report by the Washington State Investment Board. This report indicates that about 20% of the $80 billion or $18 billion is in “fixed income.” However, while fixed income sounds safe, it is not. Of the $18 billion in fixed income, only 30% or $6 billion is in Treasury Bills. Put another way, less than 10% of the $80 billion is in Treasury Bills. The remaining $12 billion in the Fixed Asset category includes risky bets like Credit Default Swaps and Mortgage Backed Securities. http://www.sib.wa.gov/financial/pdfs/quarterly/qr063015.pdf

The problem is that when this bubble pops, our State Workers and their pension funds could lose tens of billions of dollars in a matter of weeks! In fact, in the 2008 Crash, it was estimated that Washington State Pension Funds lost about $15 billion. But the Stock Market Bubble is much bigger now than it was in 2008. It is possible and even likely that the next stock market crash will wipe out more than $20 billion in pension funds. Of course, money never really disappears. So what really happens is that the $20 billion is transferred or robbed from our State Pension funds and given to Wall Street insiders in a rigged gambling casino.

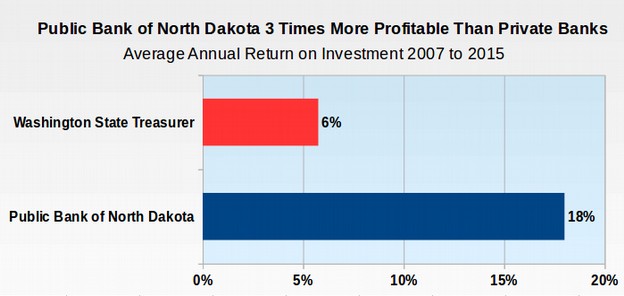

Despite taking such huge risks in the private bank gambling casino, in the 8 year period since 2008, the average return on our $80 billion has been 5.75% - which barely covers the cost of inflation. How did the Bank of North Dakota do during this same 8 year period? The average rate of return for the Bank of North Dakota was 18% - more than 3 times the rate of return of the State of Washington investments. http://banknd.nd.gov/pubs/annualreport/2014/index.html

But even $20 billion is peanuts compared to the risk of deposit confiscation

In March, 2013, something happened that most people would think was impossible. Bankers raided Cyprus banks and (legally?) robbed depositors of more than half of their assets. Large depositors lost more than 62% of the funds they had deposited. http://www.huffingtonpost.com/2013/03/29/bank-of-cyprus-depositors-loss_n_2981156.html

The Cyprus banks gambled away too much of their depositors money. Instead of holding 10% of the depositors money the way a normal fractional reserve bank would do, they held less than 5%. So their solution was to confiscate about half of the unsecured deposits of the people who put their savings in these risky banks.

The real question is whether there is a danger of FDIC and the big banks suffering a similar or bigger problem here in the US. Here is just one article that discusses this danger. http://www.huffingtonpost.com/ellen-brown/banks-confiscation_b_2957937.html

See the following 12 minute video for more information on this risk of confiscation due to a bank failure. https://www.youtube.com/watch?v=xIVRcYJvjwA

The issue is that FDIC only has a tiny fraction of the money needed to cover the collapse of a “Too Big to Fail” bank. As just one example of this problem, in October 2011, the Federal Reserve over-ruled the head of FDIC and allowed Bank of America to transfer their $75 trillion in derivate risk they acquired in their takeover of Merrill Lynch to FDIC insured accounts. Covering these losses was also given priority over normal savings accounts – and over the accounts of public agencies like the state of Washington.

http://problembanklist.com/fdic-to-cover-losses-on-trillion-bank-of-america-derivative-bets-0419/

Including the deposits from Washington State, Bank of America has about $1 Trillion in deposits. Not even Las Vegas would allow you to bet $75 when you only have $1 in your pockets. But what makes this worse is that the $1 does not even belong to Bank of America. It belongs to depositors like the State of Washington. The only reason the bet is allowed is because the US Tax Payers are on the hook to cover the bet should Bank of America lose. But should Bank of America bet the wrong way, the reality is that not even the US tax payers have enough money to cover $75 trillion in losses. So depositors like the State of Washington would see a major haircut where our State account was frozen while some judge decides how many pennies on the dollar we would get back after the collapse of Bank of America.

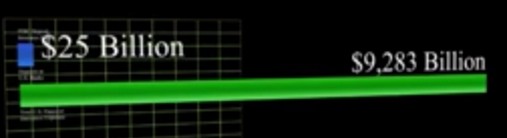

To help you estimate the amount of the haircut we will all be taking, in the past 8 years more than 200 private banks have failed in the US costing FDIC about $40 billion. On June 30, 2013, the FDIC only had $25 billion to cover $9 trillion in insured deposits. Put in plain English, FDIC had $25 to cover every $9,000 in insured deposits.

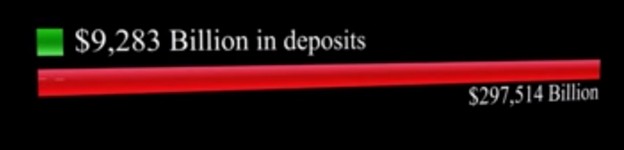

But adding $75 trillion in Bank of America derivatives to the insured deposits means that FDIC only has $25 to cover $85,000 in deposits! Even worse, the total US derivatives in 2013 was nearly $300 trillion (with Chase bank and Bank of America holding most of these gambling debts).

So this means that FDIC has $25 to cover $300,000 in total obligations. Our point is that FDIC was never intended to cover derivative gambling losses and derivatives should never have been made legal in the first place!

FDIC says not to worry. They have arranged a Line of Credit with the US Treasury of $500 billion (Bank Bailout Round 2 will not even take a vote of Congress). But this is still far too little to cover $300 trillion in gambling risks. To be precise, even with the Line of Credit (and guess who be put on the hook to pay it back) FDIC only has $500 for every $300,000 of derivative risk. http://problembanklist.com/fdic-forecasts-billion-in-losses-on-banking-failures-why-the-losses-will-be-five-times-larger-0412/

Sadly, this derivative risk problem has only gotten worse in the past few years. According to a report published by the International Bank of Settlements, in June 2014, the total derivative risk was estimated to be just under $700 trillion – most of it assumed by Chase Bank and Bank of America – in what amounts to the largest gambling casino in the history of the world. Anyone who thinks that unregulated profit driven private Wall Street banks and or the stock market are safe simply has their head in the sand. http://www.bis.org/publ/otc_hy1411.pdf

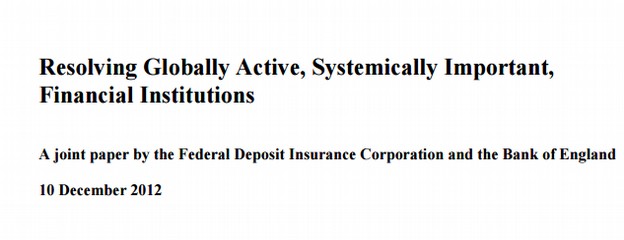

Here is a link to the FDIC report where they explain what will happen the next time the big Wall Street banks have a financial meltdown:

https://www.fdic.gov/about/srac/2012/gsifi.pdf

Keep in mind when you read this report that bank depositors – including the State of Washington – are the “unsecured credit holders” who would be expected to turn over their deposits in order to cover the losses of the big banks. The report refers to this as a “bail in” instead of a bail out. But what we really need is to prohibit big banks from gambling in the first place. Unfortunately, since Wall Street banks now control Congress, a return to the Glass Steagall Act is not likely to happen until the American people vote the current group in Congress out of office.

Keep in mind when you read this report that bank depositors – including the State of Washington – are the “unsecured credit holders” who would be expected to turn over their deposits in order to cover the losses of the big banks. The report refers to this as a “bail in” instead of a bail out. But what we really need is to prohibit big banks from gambling in the first place. Unfortunately, since Wall Street banks now control Congress, a return to the Glass Steagall Act is not likely to happen until the American people vote the current group in Congress out of office. This is why we need to find a safer place to keep our public funds. This is why we need a public bank. A public bank does not make money by gambling in the derivatives market. Instead, it makes money by financing public projects such as building public schools, public roads and public bridges. In effect, we would be keeping money in our state investing in our future and creating hundreds of thousands of good paying jobs. Folks would spend their earnings at local businesses and pay State taxes on this economic activity creating an upward spiral instead of the current downward spiral we are in by allowing bog banks to siphon off public funds for Wall Street gambling.

The Bank of North Dakota is the Safest Bank in the US!

The Bank of North Dakota has a much higher assets to debt ratio than any private bank in the US. The Bank of North Dakota also has a higher credit rating than any private bank in the US.

While every major private bank suffered huge losses in the 2008 Crash, requiring trillions of dollars in tax payer bailouts, the bank of North Dakota actually made a profit. Why? Because the Bank of North Dakota invests in public projects in North Dakota – not Derivatives gambling.

Here is a quote explaining why the public Bank of North Dakota can make a profit when all of the other private banks in the nation are failing:

“The Bank of North Dakota’s costs are extremely low: no exorbitantly-paid executives; no bonuses, fees, or commissions; only only one branch office; very low borrowing costs; and no FDIC premiums (the state rather than the FDIC guarantees its deposits).”http://ellenbrown.com/2014/11/19/wsj-reports-bank-of-north-dakota-outperforms-wall-street/

In other words, there is no risk of the Bank of North Dakota collapsing if the FDIC collapses because the Bank of North Dakota is not part of FDIC. So while any public funds or other unsecured deposits in private banks could be frozen of even confiscated to pay the private bank gambling debts, any deposits in a public bank would remain completely safe. The risk is ZERO while the rate of return is 3 times greater!

Now that we understand the extremely dangerous risk of continuing to keep billions of dollars of public funds in unregulated Wall Street private banks, in the next article, we will look at the other places we could be investing our money – in building urgently needed public schools and creating hundreds of thousands of jobs right here in Washington State!